The CB Insights report highlights the top 12 tech trends to watch in 2022. The report is published by tech market intelligence platform, CB Insights – they analyzed signals like investment activity, executive chatter in earnings transcripts, and media mentions to identify the trends. The 70-page report digs into the following 12 trends:

- Next wave of telehealth. Big tech companies, retailers, and telecoms will compete with existing healthcare players for the $30B+ remote patient monitoring market.

- Crypto crime. The crypto security space will expand to address rising cyber crime as hackers continue to evolve in their tactics.

- Direct-to-avatar. Mass fashion brands will go all in on the avatar economy as the metaverse, NFTs, and digital identities take off, and the low cost of development and huge user bases entice a deluge of entrants.

- Virtualizing the clinical trial. In silico techniques will cut the time and money it takes to develop a drug and insulate clinical trials from disruptions like Covid-19.

- Net-zero or bust. Climate tech is becoming a VC darling, but high capital costs and murky claims will pose tough challenges for investors.

- Ultrafast convenience. Retailers will join forces with cash-burning ultrafast delivery companies to help win over consumers.

- De-risking supply chains. Manufacturers, retailers, and other stakeholders will turn to digital twins and the microfactory model to bolster their operations.

- The electrification of everything. Battery tech will make huge advances this year, bringing the promise of electrification to everything from planes to basketball shoes.

- The consumer privacy battle. Consumer privacy will take off as a strategic business priority in 2022 — which could end up giving big tech an even greater advantage.

- Killing the credit card. Buy now, pay later purchases will become more frequent and higher value as millennial and Gen Z shoppers gravitate away from traditional cards.

- Lab-to-table. Regulations will finally allow lab-grown meat to hit restaurant tables and grocery store shelves and begin competing against traditional meat and plant alternatives.

- Fusion energy. Advances in AI and a startup funding splurge will push the long-sought clean energy source closer to reality.

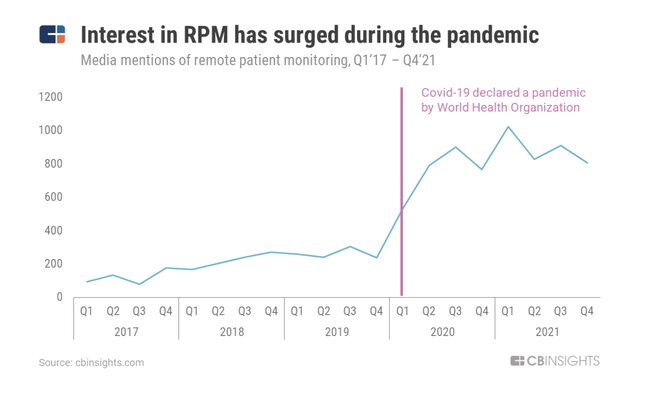

Next wave of telehealth

Big tech companies, retailers, and telecoms will compete with existing healthcare players for the $30B+ remote patient monitoring market.

The Covid-19 pandemic upended healthcare in countless ways, but one outcome showing staying power is the rise of remote patient monitoring (RPM) — tech that tracks key vitals and metrics while patients are away from typical medical settings. While RPM has been gaining traction for several years as a way to reduce costs and improve the patient experience by enabling a tech-driven “hospital-at-home” model, the approach took off as lockdowns and overburdened hospitals led to an enormous surge in demand.

Digital biomarkers are consumer-generated physiological and behavioral measures collected through connected digital tools.

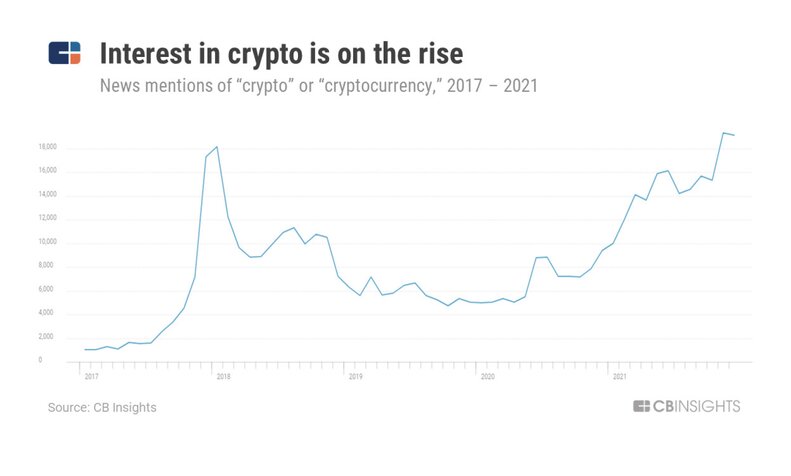

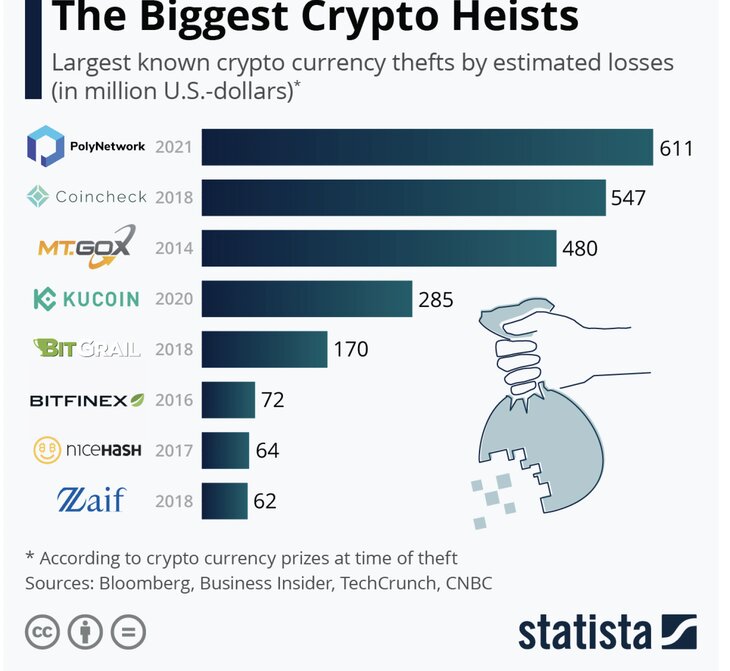

Crypto Crime

The crypto security space will expand to address rising cyber crime as hackers continue to evolve in their tactics. Interest in crypto is higher than ever before. Spending opportunities are increasing as more companies — from Starbucks to Whole Foods to KFC — begin to accept cryptocurrencies like bitcoin as a form of payment.

Though illicit activity reportedly accounts for less than 1% of crypto transactions, reports of crypto crimes have risen an average of 312% every year since 2016. These include hackers stealing coins from investors, individuals falling for crypto investing-related scams, and more.

As of 2021, there are over 300M crypto users around the world and more than 18,000 businesses accepting crypto payments.

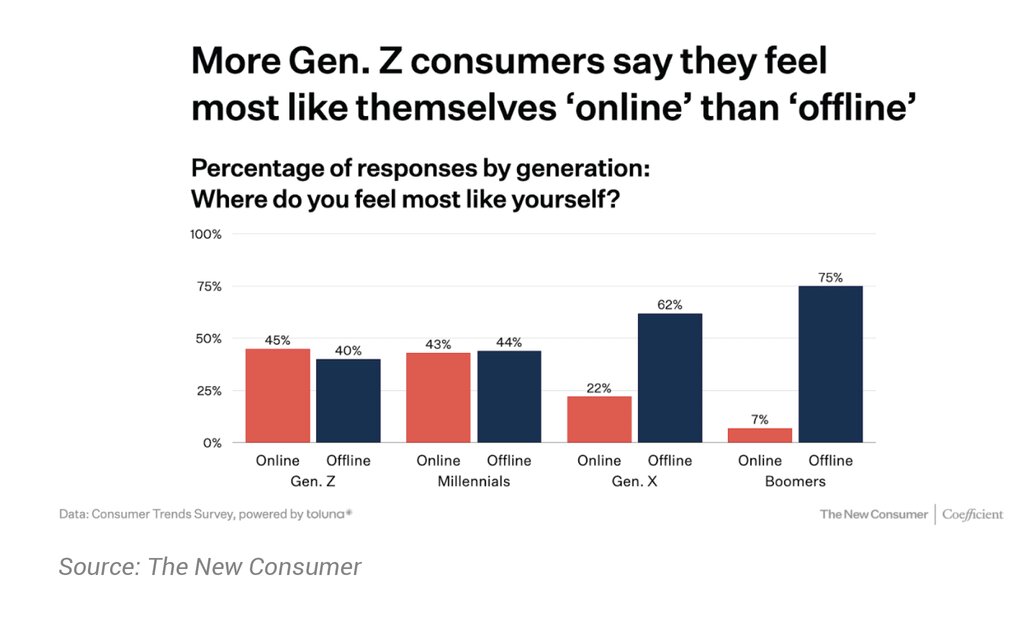

Direct-to-avatar

Mass fashion brands will go all in on the avatar economy as the metaverse, NFTs, and digital identities take off, and the low cost of development and huge user bases entice a deluge of entrants.

While there is massive potential for brands going D2A, opportunities — via minting NFTs or launching in-game virtual content more broadly — hinge on 1) branding and 2) monetization. By entering virtual worlds, brands can engage with large, young audiences where they’re spending much of their time — active Roblox users, for instance, average 2.6 hours per day on the platform.

Eventually, brands may work directly with users-turned-creators (like the ~1.3M developers on Roblox) who have the skill sets and gaming experience to develop these goods and installations, predicts Meagan Loyst, Gen Z VCs founder and Lerer Hippeau investor. Gucci, for example, partnered with popular Roblox creators and designers cSapphire and Rook Vanguard to develop its virtual items.

Virtualizing the clinical trial

For potentially life-saving drugs and treatments, the road to commercialization is steep.

On average, it costs $2.6B to research and develop a successful drug and takes 10+ years to come to market. It’s estimated that in vivo testing (testing on animals and humans) accounts for more than 75% of the total cost, with recruitment alone being one of the biggest barriers to drug development — only 6% of clinical trials are ultimately completed on time.

In 2022, we’re likely to see more pharma players incorporating in silico tech into their pipelines as a layered approach to make clinical trials more efficient and resilient. We’ll also see more regulators like the FDA and the EU’s EMA outlining best practices for collecting and analyzing data like digital evidence

Net-zero or bust

With climate-friendly technologies maturing across a broad array of sectors and investor demand booming, the coming year is set to be a breakout moment for sustainability investment. Watch for an increasing number of high-valuation exits and announcements of advances across several climate tech areas. Some high-profile startup failures in the space are inevitable — but, at least for now, don’t expect them to do much to dent investor sentiment.

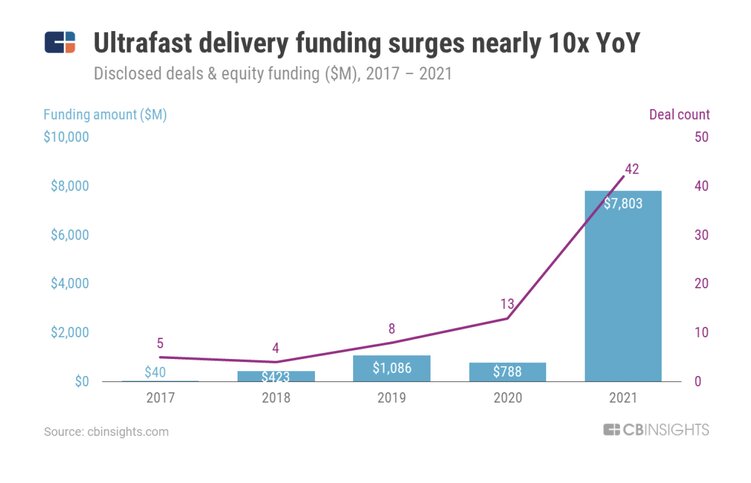

Ultrafast convenience

Retailers will join forces with cash-burning ultrafast delivery companies to help win over consumers.

Urban consumers’ preferences for instant gratification, combined with a shift away from physical retail amid the ongoing pandemic, propelled US ultrafast delivery sales to an estimated $20B to $25B in 2021, according to Coresight Research.

Now, the e-commerce model of “speed is king” — which Amazon kicked off in 2005 with 2-day free shipping — is being pushed to the limit. Funding to startups offering delivery in 10 to 20 minutes surged nearly 10x year-over-year in 2021 to approach $8B.

De-risking supply chains

Manufacturers, retailers, and other stakeholders will turn to digital twins and the microfactory model to bolster their operations. Long-standing cracks in global supply chains came into sharp focus last year, as pressure from forces like the pandemic, weather events, labor shortages, and port congestion mounted. This has created a swell of demand for tech solutions that can provide a step change in the resiliency, agility, and efficiency of logistics networks — and allow manufacturers, suppliers, and retailers to shift toward more proactive business models.

Key market drivers in supply chain innovation include:

• Digitization: Technologies like digital freight matching and blockchain-based asset-tracking are better matching supply with demand and improving data access and value.

• Visibility: Demand forecasting and visibility platforms are helping businesses identify and respond to inefficiencies and potential disruptions.

• Automation: Robots are proliferating across the supply chain, enabling capabilities like robotic fulfillment, autonomous ground and drone delivery, and more.

The opportunity is massive. For one, the retail industry lost an estimated $1.14T to out-of-stock items in 2020. On top of that, being able to deliver a product in 2 days, rather than 7-10, can boost sales by 40%. Making it happen in 1 day leads to sales growth of 70%, according to Deliverr.

Digital Twin

Digital twins are one of the most promising solutions here. The $32.2B market is shaking up supply chain management, enabling simulation of an organization’s supply chain, including potentially thousands of vendors, warehouses, logistics processes, and more.

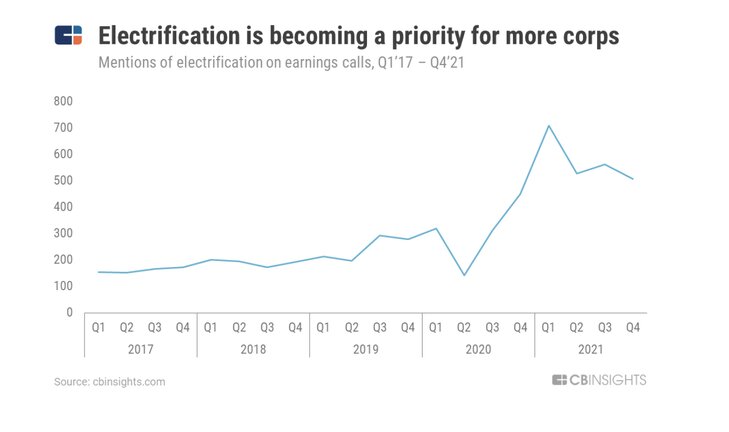

The electrification of everything

Battery tech will make huge advances this year, bringing the promise of electrification to everything from planes to basketball shoes. We see the move toward electrification every day. Buses amble past propelled by silent electric engines, homeowners are installing power-generating roof tiles, and some athletes are even wearing electric shoes that adapt to the shape of their feet.

Mainstream electrification is set to reach new heights in 2022 as a growing number of companies, investors, and governments place big bets on the technology and cheap sources of clean energy become more abundant. Meanwhile, a number of corporations and well-funded startups are poised to make leaps in battery technology that will set the stage for mass electrification across countless industries.

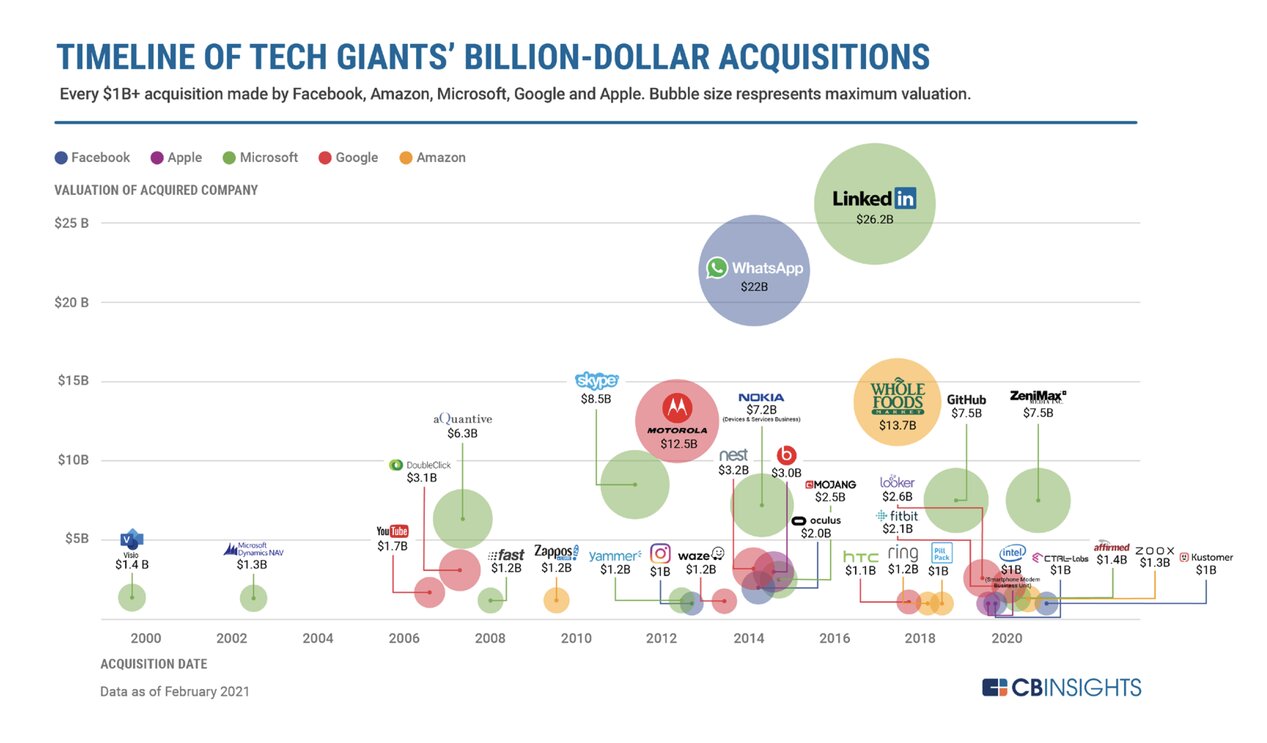

The consumer privacy battle

Consumer privacy will take off as a strategic business priority in 2022 — which could end up giving big tech an even greater advantage. Over the past 20 years, tech giants like Amazon, Facebook (aka Meta), Google, and Apple have amassed unfathomable amounts of user data. While the increasing generation and collection of consumer data has spurred innovation, it has also given rise to security concerns and set off waves of consumer privacy regulation (like the EU’s General Data Protection Regulation, or GDPR) over the past few years.

• Google announced that it aims to phase out third-party cookies and launch a Privacy Sandbox by 2023 in order to enable personalized ad delivery while protecting user privacy.

• In April 2021, Apple launched its App Tracking Transparency feature via its iOS 14.5 update, allowing users to disable ad tracking for certain apps. This update has forced developers to not only allow users to opt out of tracking — which has been possible in the past — but also to explicitly provide users with the choice in a pop-up prompt before the app is even used.

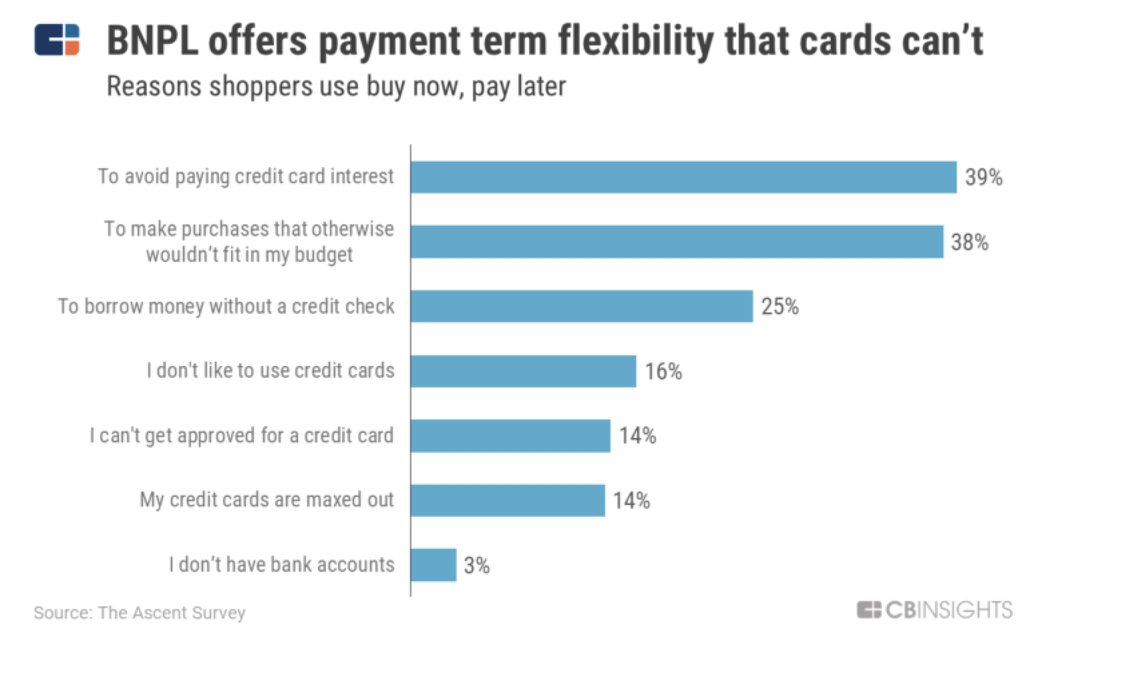

Killing the credit card

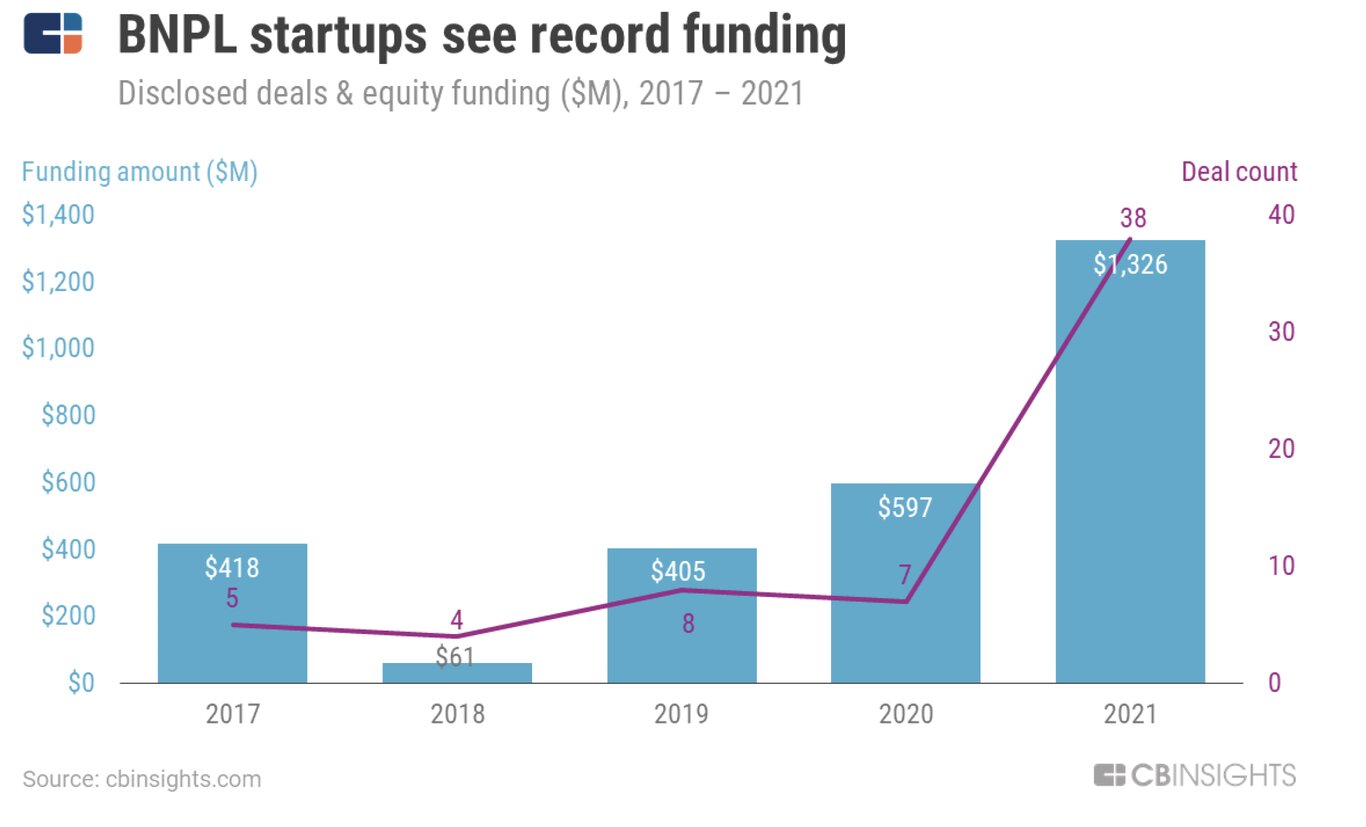

Buy now, pay later purchases will become more frequent and higher value as millennial and Gen Z shoppers gravitate away from traditional cards. As the Covid-19 pandemic drove unprecedented levels of e-commerce shopping, point-of-sale (POS) financing — or “buy now, pay later” (BNPL) — saw a huge boost while credit card balances dropped to their lowest point since 2017. Currently, BNPL still reflects a small portion of the overall spending on payment cards (including credit, debit, and prepaid cards), an industry that sees roughly $8T in annual spend volume in the US.

As consumers increasingly rely on digital channels for many interactions, and as BNPL becomes more familiar, it stands to reason that more shoppers will choose these solutions for bigger and bigger items in 2022 and beyond. BNPL providers are already beginning to up their spending limits — Affirm now approves payment plans for as much as $17,500.

Lab-to-table

Regulations will finally allow lab-grown meat to hit restaurant tables and grocery store shelves and begin competing against traditional meat and plant alternatives. Lab-grown (or “cultivated”) meat companies, which make meat using animal-derived cell cultures, have existed for years — but to eat their products, you’d have to sign a waiver. These companies have been awaiting regulatory approval, and are not yet able to bring their products to market.

Fusion energy

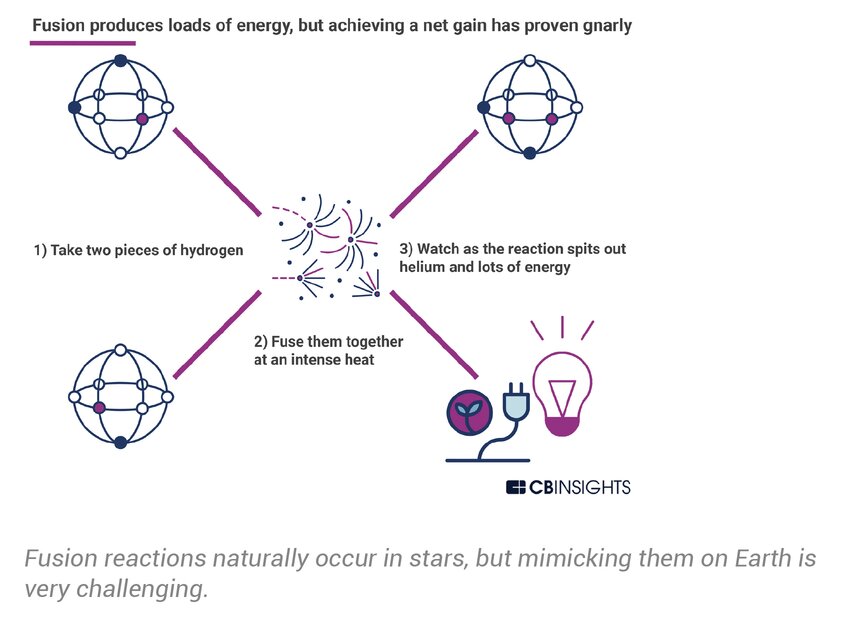

Advances in AI and a startup funding splurge will push the long-sought clean energy source closer to reality. The allure of fusion energy is easy to understand — it could offer an effectively unlimited source of energy that’s safe to use and doesn’t produce carbon emissions. It also could become a powerful tool to help ward off climate change as a more reliable complement to renewables like wind and solar.

Fusion energy works by bringing the nuclei of two atoms together to make a new single nucleus. In the case of hydrogen, the energy holding together the resulting helium nucleus is less than that required for the two originals. The difference is released as energy — a lot of energy. This is the same basic process that powers the sun.

Need help with developing a digital strategy for your business? Get in touch.